This is a question many homeowners ask themselves when it comes time to pay, and it depends primarily on the property registry, which is the tool used by governments to collect taxes. These taxes are based on various parameters, such as the built surface area, the type of use of the property, and the age of the construction or renovation.

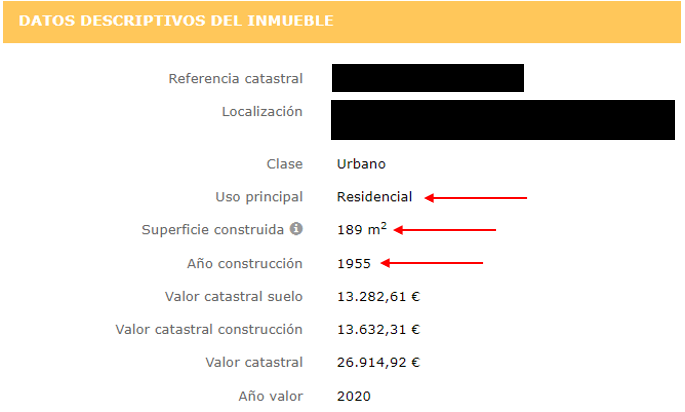

But to see if we pay our taxes correctly or not, what we must do is first check if the surface area, use and year of construction correspond to reality. To do this, we will go to the page https://www.sedecatastro.gob.es/Accesos/SECAccInmuebles.aspx and through an electronic certificate (or through a person who has it) we will access our cadastral data:

With this data, we'll verify that the usage, built area, and year of construction are correct to determine if we're paying the correct amount.

But what happens if we are faced with the case in which some of the data does not correspond to the reality of my property:

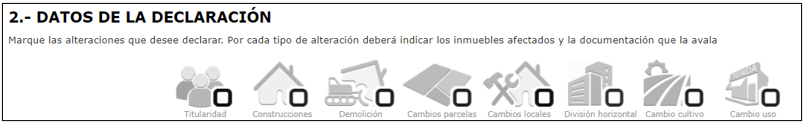

To this end, the land registry has enabled a procedure called "Declaration of cadastral alteration of real estate. Form 900D"

Through this procedure we will be able to:

- Change of ownership: Providing supporting documentation (purchase deeds, etc.)

- Register constructions, extensions, and/or renovations: To do this, we'll need documentation of the work, plans, photographs, and the cost of execution.

- Demolition: After a demolition, if the land registry is not notified, payments will continue as if no demolition had been carried out until the next cadastral regularization. This aspect is rectified by providing the details of the demolition work.

- Plot changes: To group, segregate, or divide plots, this procedure can be carried out by providing the relevant plans.

- Cambios locales: se trata de el mismo proceso que el punto 4 pero para locales.

- Horizontal division: For homes with horizontal division and each owner is registered in the cadastre as appropriate, both the division plans and supporting documentation (deeds) must be submitted.

- Change of crop: Depending on the type of crop the farm has, it can be modified in the land registry by presenting the supporting documentation.

- Change of use: In the event of a change of use from residential to warehouse/garage or vice versa, this procedure is permitted to regularize the use of the property.

All these procedures can be carried out through the land registry platform and to speed them up, a graphic validation report (IGV) can be added, which must be carried out by a competent technician to be validated.

What is a graphic validation report (GVR) and what is it used for?

This standard cadastral report is a document that reflects the property's georeferenced coordinates and is used for both plot modifications and building modifications. Nowadays, in addition to cadastral modifications at the owner's request, it is often requested when executing deeds for rural land to ensure full coordination between the cadastre, property registry, and notary (deeds).

This type of report defines the plot boundaries with absolute precision, making it a highly recommended document in cases of boundary disputes.